News and Publications

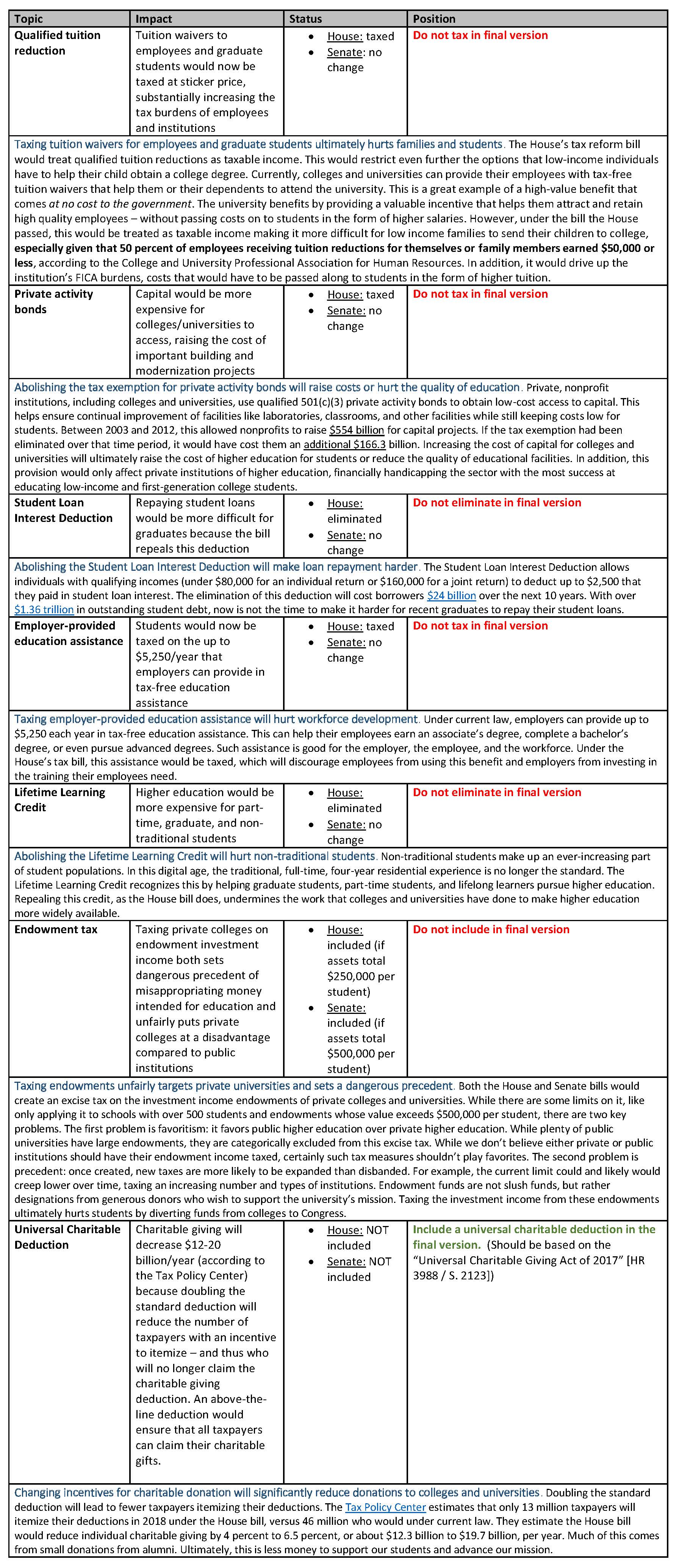

WASHINGTON – As the House and Senate seek to reconcile their two tax legislation proposals, there are many provisions that will have a negative effect on Christian Higher Education, and higher education generally.

The tax plan will make college more expensive. With its emphasis on cutting corporate tax rates, the House plan is predicted to increase the cost of higher education by $71 billion over the next decade through changes to higher education tax benefits, according to the Joint Committee on Taxation.

Higher education produced tax payers. Higher education transforms graduates’ careers and earning potential. People over age 25 with a bachelor’s degree earn 67 percent more per week and are only about half as likely to be unemployed as those with just a high school diploma, according to the Bureau of Labor Statistics. This ultimately translates to graduates paying higher taxes and relying less on the social safety net.

Keeping higher education affordable is important to enable graduates to pursue important — but underpaid — helping professions. Graduates of CCCU institutions are more likely to go into service-oriented careers like teaching or nursing than graduates of other institutions of higher education. CCCU graduates are three times more likely to pursue a career in human services than graduates from all 4-year institutions. Our graduates are future pastors, nurses, teachers, therapists, paramedics, and police officers. These positions are not high paid, but they are vitally important to society.

Colleges and universities are economic drivers – what’s good for them is good for the economy. They employ a wide range of employees, from professors to plumbers, from chaplains to chefs, from graduate assistants to gardeners, and from CFOs to coaches. Whether in major cities or rural towns, institutions of higher education have important economic impacts. In total, CCCU institutions employ over 66,000 full-time faculty and staff.

Colleges and universities contribute to communities – what’s good for them is good for the community. Higher education institutions are centers of community, bringing people together over basketball and ballet, theater and tennis. Students and staff volunteer at local nonprofits. Especially in rural areas, institutions of higher education provide opportunities to engage and experience athletics and the arts. As evidence of their commitment to their communities, our students complete 5.4 million hours of community service each year.

This bill is bad for students, bad for higher education, and undermines a knowledge economy. Congress has historically recognized the value of higher education, as evidenced by creating landmark measures like the GI Bill and Pell Grants. With the growing importance of the knowledge economy for global economic competitiveness, now is not the time for the United States to retreat from higher education or make it less affordable for those who need it most.

Specifically, here are the provisions that remain deeply concerning:

[Download this chart as a PDF.]

CCCU institutions are encouraged to calculate the specific impact on their institution and to share that with their Congressional delegation, employees, and community. Congress’ attempt to reform the tax code should not come at the expense of the nation’s institutions of higher education or the social mobility that higher education provides those who seek a better life for themselves or their family. The CCCU is committed to making higher education affordable and available to all. We call on Congress to join, not undermine, these efforts.